The free market is defined by the allocation of resources based upon the functioning of the price mechanism. This takes into account the equilibrium between demand and supply schedules. In this essay I will argue that while the price mechanism may be efficient, there are cases where it fails. Specifically focusing on the case of monopolies and then market failure whereby there are externalities.

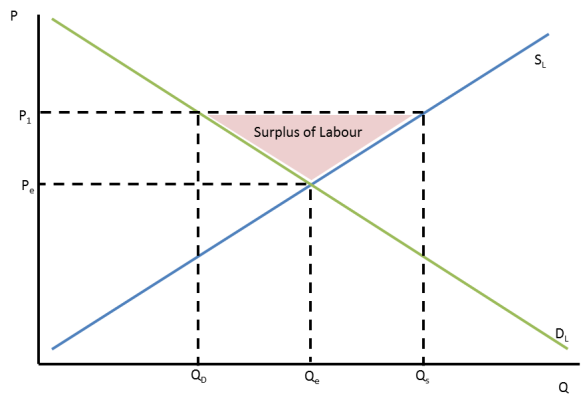

The price mechanism does provide efficiency, through the price signaling created by demand and supply schedules. This brings us to a point of equilibrium that is Pareto optimal as neither consumer or producer can be better off without the other being worse off. Furthermore, at this equilibrium we also achieve allocative efficiency, suggesting that there is the best allocation of resources possible. This is shown through the diagram below, at the equilibrium of Qe – Pe.

We may note that there is producer and consumer surplus, this defines our parameters of Pareto efficiency, any move from the market clearing equilibrium either the producer or consumer may be worse-off. This is limited by not considering the type of market structure that is present.

The monopoly market structure provides evidence for the possible inefficiency that may be incurred through the price mechanism system. This is a consequence of monopolies being able to set their prices, and looking to profit maximise at the point where MC=MR as seen below:

The scenario above takes the market away from away from allocative efficiency, and incurs a deadweight loss. This is a result of there being social welfare, which is not taken by the consumer or producer (shown below).

The scenario above takes the market away from away from allocative efficiency, and incurs a deadweight loss. This is a result of there being social welfare, which is not taken by the consumer or producer (shown below).

This prices out a range of consumers, so the deadweight loss represents transactions that could have occurred and would have been socially beneficial, but have not occurred. This point is not Pareto optimal as the consumer is worse-off, nor is it allocatively efficient. Allocative efficiency and Pareto optimality could be achieved if the monopoly were to go to the equilibrium of Qe-Pe, this would mean the firm prices at the point where MC=AR, returning to market clearing.

It is important to note that a monopoly may achieve dynamic efficiency, which is unlikely for a perfectly competitive firm as a consequence of having normal profit. The monopoly gains abnormal profit (as shown by the profit margin in graph 2) that can be used for research and development. Taking the example of pharmaceutical companies, it can be noted that this abnormal profit is required for new drugs to be developed, otherwise at the cost of innovation perfectly competitive firms would not be able to supply new or better drugs which may benefit society.

We must also consider inefficiency incurred through firms pursuing aggressive tactics such as using the abnormal profit to set up legal barriers, attempt to takeover smaller firms, and abuse the economics of scale to lower the price in order to stop firms entering the market. This generates greater inefficiency in terms of reducing consumer’s welfare while also ensuring future inefficiency as barriers to entry. An example of this behaviour was shown by the De Beers diamond cartel in the 1980s, where it had a market share of up to 90% (Zimnisky, Paul). This was achieved through persuading independent mines to join the cartel; if they chose not to they would flood the market with diamonds reducing their price thereby pricing them out. They also dictated price through stockpiling in order to limit supply (Zimnisky, Paul). Exemplifying firm behaviour through the price mechanism that yields inefficiency in terms of societies welfare.

The price mechanism may also fail to provide efficiency as a consequence of externalities, which are an effect on a third-party that was not involved in the original transaction that is not accounted for in the price. The degree of inefficiency tends to correlate with the typology of the good in question. The manner in which the market forces operate suggests that the price mechanism is still operating efficiently due to the market clearing, as the externality is not directly shown. We must also consider that there can also be a deadweight loss in this scenario. The externality as an inefficiency may be shown through considering marginal private cost and marginal social cost, in that the market equilibrium is at the price and quantity that corresponds with marginal private cost, not accounting for the social cost:

However, this can be countered by the efficiency stated through the Coase theorem. Suggesting that if bargaining in regards to an externality can occur, then an efficient outcome will be reached, providing there are negligible transaction costs. This scenario is shown below:

In this the net social gain is a result of bargaining in regards to the externality between the two parties, which results in net social gain. This is due to the loss of profit, take for the conventional example used of wind turbines and noise. The turbine company is willing to compensate people suffering from the noise due to the greater gain of using the wind turbines. There is also the opportunity to be Pareto optimal at Q1. However, this theory is limited by assuming the negligible transaction costs, which in reality tends to not be the case.

Consequently, we may examine methods of dealing with externalities, such as taxation and compensation. The case of tax effectively raises the cost of the good or service in order to account for the cost of the externality. Depending on the elasticity of demand we may note a change in the quantity consumed, regardless of that the price is “corrected”. Shown below:

Here the red highlighted area represents the active externality. With the size of the tax shown through the shifting upwards of price. Now at Q1 we operate at a Pareto optimal point, while the cost is at C2, when originally at the cost of C2 there would have been Q2 consumed. When we consider compensation, the total compensation paid is up to the point where cost first meets marginal social cost. With the Pareto optimal quantity at Q1, this makes up for the cost that is unaccounted for in the original transaction, as shown below:

Even though these are theoretically capable of dealing with an externality in order to yield an efficient outcome, we must consider that the government carries them out. Therefore, there is government inefficiency that may be carried through the initial inefficiency of the price mechanism, this is due to the inability to determine the degree of compensation or tax that is required to bring price to the point of market clearing.

Take for example the externality present with industrial fishing. While fishing occurs we may assume that the amount of fishing occurring is so that there is supply to meet demand in order for the market to clear at equilibrium. However, this does not account for the negative effect on fish stocks. Due to the demand for fish exceeding the reproductive rate of fish there is a strain on fish stock. Furthermore, the methods by which fishing occurs such as trawling may adversely affect other sea life. Quotas can prove inefficient in dealing with this problem due to the lack of infrastructure related to dealing with each fishing boat and the policing required. Moreover, this can lead to fisherman using the same methods then stock dumping which also carries negative effects towards the health of sea life. We would not consider tax, as it is not in the government’s interest to raise the cost of living for the population, this leaves compensation. This may be towards subsidising fish farms, reducing the burden on natural fish stocks. Additionally, it could go towards subsiding the fisherman to the decrease in revenue if they were to fish by less efficient but more environmentally friendly means.

In conclusion, we may note that the price mechanism can at times be relied upon for providing efficiency. However, it may fail when we consider market structures such as monopolies, or the case of externalities where there are inefficiencies that are unaccounted for in the market equilibrium. To refine this analysis of price mechanism efficiency we would consider the typology of the goods in services in question such as merit and normal goods, or common access resources.

Almog Adir

Bibliography

Zimnisky, Paul. “A Diamond Market No Longer Controlled By De Beers.” Kitco Commentary. 06 June 2013. Web. 02 Nov. 2014.

Copyright Almog Adir © 2014 · All Rights Reserved · My Website