While this projection is based on linear growth rates it is still relatively in line with what U.N. reports have suggested. Nigeria is an interesting case, initially the country was seen as the classic case of resource curse, but increasingly it is able to translate its resources into sustained growth and some alleviation of poverty. The projections above are something quite extraordinary in terms of population growth, so I am curious what the economic repercussion will be. Noting the nature of growth projections being quite rigorous in that we have comprehensive data combined with an understanding of time lags.

Monthly Archives: November 2015

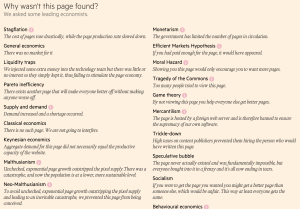

The Financial Times Being Mildly Amusing

Image

Between Debt and The Devil – Adair Turner

Adair Turner recently came to speak in the Bristol Festival of Ideas. With his talk being centred around the ideas he explores in his new book “Between Debt and The Devil: Money, Credit, and Fixing Global Finance”

You can find the recording of his entire talk in the link below, as well as an interview done with him which is particularly interesting:

http://www.ideasfestival.co.uk/events/adair-turner/

He highlighted some feasible ideas, and some less so, but overall it was fascinating to see the opinions of someone who was in a position of considerable authority post crisis as he was the chairman of the Financial Services Authority. Below I have highlighted parts of his talk:

Turner outlined two main problems which he believes are facing modern economies

Problem 1

Rising Inequality

- Problem of secular stagnation

- Savings of the rich are too high (MPC too low)

- Capital saturation especially in the US

- Stagnated Wages

- Specifically applied to the United States

- Trickle down economics was invalid

- Credit was the aspect of the subprime mortgage boom

- People with low wages were finally able to access credit for toxic assets

The Role of Real Estate

- Fundamentally ignored by Economics

- Safe and over credit intensive

- Turner highlighted that we need to address the credit intensiveness of our economies

- Namely with suggesting that bank capital ratios should be around 20% rather than 4-5% if progress it to be made in this area.

Global Balance of Payment Imbalances

- Surpluses are driven fundamentally by credit

Problem 2

“We have run out of ammunition to stimulate our economies”

- Fall back of the central bank printing money to drive forward inflation and bump the economy

- Severe deflationary trap can always be solved by helicopter money

- Certain circumstances which can get us out of this trap

- Not necessarily producing hyperinflation (smart printing)

- The problems here are fundamentally political

- Taboo of Money Finance amongst politicians

- Once they realise its possible, what will stop them from doing it further

- Suggesting political policy to moderate such a tool

- Japan and Eurozone specifically need this

- Once they realise its possible, what will stop them from doing it further

- Between Debt and the Devil

- Taboo of Money Finance amongst politicians

- Severe deflationary trap can always be solved by helicopter money

Two ways to ensure expenditure in aggregate nominal demand

- Print and Government Spending (Devil)

- Private financial system to push through purchasing power rejuvenation

- The free market in this case led to the extreme inequality

- Markets fail and run out of control, and they were let free and not cared for

- Choosing between alternative risks – private debt or government irresponsibility

The skeptic in me suggests that most of his proposed ideas were book selling ideas, but there is a valid discussion around the use of helicopter money, and our increasing lack of ability to dictate our economies when needed. We seem to be vehement supporters of free market economies, but then become increasingly frustrated when our targets of growth or inflation are not reached. So if this is to be the case it is clear we need to make some compromises in these areas, namely addressing economic literature and bringing it into use rather than going back to conventional heterodox policy and the shortcomings which have become frequently apparent.

One little area that annoyed me was his reference to how something like tax rebates would work in regards to spurring aggregate nominal demand, as a method of overt monetary finance. As it has been conclusively shown that consumers will not directly translate this into spending, and if so it is purely transitory and has no long run permanent effects. There is some merit in other examples he used of potentially using overt money financing such as introducing large infrastructural programmes. This has often been a go to idea though for trying to prompt long term growth, not saying that it is a bad one but we tend to mismanage our ability to commit to long term projects.

More to come this week, the next post on ‘Corbynomics’ and nationalisation.

Corbynomics – Nationalisation Part 1

A truly disastrous title, I will never really understand the need to try and produce catchy names out of policy ideas. Regardless, it is not even really Corbynomics because these ideas have not come from his flat in North Islington.

So we are going to start with re-nationalisation of the Gas and Rail industries. It is important from the onset to appreciate that these are two very different industries, and consequently pose different problems in regards to how they may be nationalised. This post will start with rail.

The form of privatisation that took place in the rail industry is by no means conventional. At the moment Network Rail is the owner of infrastructural assets such as the rails, signals, stations, etc. and this company is government owned. While the operation of these railway lines is effectively sub contracted to single companies, with a distinction between rolling stock operation companies and train operating companies.

To simply understand the current system we may view it as something alike to the franchise model, the Office of Rail Passenger Franchising puts to tender contracts to operate portions of rail network, which are then bid for by private companies. Nationalisation would see the government take back all of these contracts into a government owned company resembling what was initially British Rail.

From various research reports and analysis, the current privatised system does not have such clear benefits compared to a government owned system. From an initial look one would note that anyways the government already heavily subsidises the industry with taxpayer money, for passengers to only then be victim to at times predatory pricing.

The theory behind a strong and dynamic competitive market to produce the best outcome for customers and firms is valid, but I would hardly call the rail industry an example of complete privatisation. If one was go to a train station now in a non-central city, they will find that they actually only have one company which they can choose to travel with. So where is the competition? Well the answer is that it is meant to be in the bidding process for the contracts, but it’s hard to see how that translates into direct benefits for the customer.

Even more frustratingly these companies take government subsidies, but still produce convenient profits to then dish out in the form of bonuses for their staff. Of which in some cases is going abroad as these companies are owned by European rail companies simply operating through subsidiaries in the UK examples being SNCF and Deutsche Bahn. Not to mention the lack of transparency in the bidding process itself. So in the best of cases it is unclear where the competition is coming from, and why this type of competition would lead to consumer benefits. Passengers can still be held hostage by the train driver unions as seen during the First Great Western strike earlier this year.

The two main problems people have are overcrowding and being priced out. Would bringing it back into government ownership solve these problems? Well at the moment it is clear the private system currently running is not solving them. Not forgetting to mention there have not been vast improvements in the rolling stock either (a promise that modern technology in trains would be a common sight in privatised rail), South West trains still don’t have air conditioned carriages or even Wifi.

The system clearly needs change. In my opinion it all needs to be in government ownership, or to find a manner in which to privatise everything but have dynamic and progressive competition. I agree here with Corbyn (which is rare) that this area needs serious reevaluation.

The below section is effectively price frustration that is simply extension to the problem (accurate at the time of checking):

If I book a ticket one month in advance for London Kings Cross to Manchester Piccadilly on a Monday at 7:40 the ticket costs £113. Lets hypothesise I have to take this hour in order to get to a meeting, and I don’t want to sacrifice weekend (even then one would need to a book a night in a hotel then, which in itself is not a cheap affair). One may argue that this is an accurate cost representing the time and nature of the trip, the main issue is that I don’t have any other choice but to go with Virgin. That is unless I went from Kings Cross to Birmingham New Street, and then to Manchester which I get to pay £92 instead. Any decent European would be shocked people pay these prices for rail travel, especially seeing that the government is already subsidising it…