Three of our favourite things, well at least mine. The election is in full swing here in the United Kingdom, and there is currently the build up to the primaries in the United States.

In the case of the United Kingdom we are facing an election of considerable uncertainty, the outcome of a coalition is highly expected considering current polling. But it will undoubtedly come up to post election day to see who can craft this arrangement.

In the liberal air of university one may find incredible support for the Green party, on the premise that a vote for them is a vote for the beginning of change in parliament, even though they themselves have basically stated it will be near impossible for them to have a serious impact on decisions or push through any of their manifesto ideas. So the disillusionment with the two party system has become ever-clear. The general distaste for austerity based policy is also extremely clear.

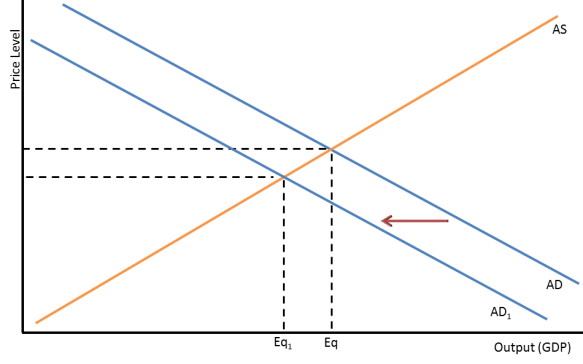

The question is should we do a u-turn right now? Krugman says yes, undoubtedly. He was ferociously battling Austerity based policy 5 years ago, and in this last week released an article which is his parade lap of saying he was right and still is right.

http://www.theguardian.com/business/ng-interactive/2015/apr/29/the-austerity-delusion

The only issue is, is that he is not necessarily right. We don’t get the opportunity to test out economic policy in isolated environments, he is basing his success by noting the apparent failure of austerity. Yet we lack an example of any economy which didn’t pursue austerity after the financial crisis. Fiscal based stimulus may have equally failed, but we will never be in the position to know for this occasion.

I am not defending austerity in any manner but I would be cautious to jump onto the other boat, Krugman himself noted while yes a deficit can be managed for a long time there is a point where it is undoubtedly damaging to the health of the economy. Austerian economics is by no means popular or in the post financial crisis economy that effective. However it does highlight a period in which we have explored unconventional policies. The main issue with austerity has been the inequality which it has helped perpetuate, this can be seen in regards to the year on year increase of millionaires and billionaires, but an increasing rate of poverty in developed economies. One may ask who the government is serving, the people as they should be? or the special interests of large corporate institutions? As it is clear that the growth that we have achieved has not been felt by the marginalised factions of society.

I mentioned earlier the upcoming primaries in the United States, I have taken this example specifically due to the data available in regards to where the money that supports candidates comes from. Take the sample below between two democratic primary candidates Hillary Clinton (who has just recently launched her campaign with an advertisement showing how she supports the “regular” American) and Bernie Sanders.

Hillary Clinton has received donations from Citigroup, Goldman Sachs, Morgan Stanley, J.P. Morgan, Credit Suisse, etc. The list goes on. Obviously this does not mean that she will enact policy specifically to disadvantage the people while supporting the financial industry. However, there is a distinct conflict of interest. In comparison to Bernie Sanders he has mostly received contributions from workers unions, and manufacturing related companies. If one was to argue who is more likely to serve the peoples interest, from a financial standpoint it would be Bernie Sanders. But even in this case I believe that campaign contributions to some degree cause a conflict of interest. How can we expect politicians whether they are in the United States or the United Kingdom to make economic policy decisions without an appreciation of the influence that arises from campaign contributions, party contributions, and the coaxing of lobbyists.

The reader will have no doubt that I lean towards the right in regards to political and economic policy. However, I believe that governments have betrayed their ultimate purpose – “serving the people”. With a smaller government I would argue there is less room for financial pressure on elected politicians. As well as the issue of career politicians who get to enjoy the warm cushion of contributions for their entire lives. This is not a comment on the lifestyle or pay of politicians, but how their position is compromised due to the nature of money in politics.

This is critical when we come to assess the type of economic policy whether fiscal or monetary that countries push through. Austerity can seem like a valid decision on the basis that the government would not be crowding out investment, while offering expansionary monetary policy on the side. This has not helped the integral strength of the economy, but specific sectors. While we clearly understand the failures of over-specialisation regardless of how developed the economy.