Fixed Costs → do not vary with output

Variable Costs → vary with output

Revenue of a firm is always dependent on the output.

Materials → Variable Cost (leather, stitching, etc.)

Capital → Fixed Cost (sewing machines, leather tanner, etc.)

Labour → Fixed/Variable Cost (depends on type and payment)

Transport → Fixed Cost (short term)

Marketing → Fixed Cost (does not vary with output)

Factory → Fixed Cost (same size, does not vary with output)

Short Term: The length of time in which one factor of production is fixed (factory determines whether or not the firm operates in the short term or the long term).

Long Term: The length of time over which at least one factor of production becomes variable (i.e. need a new factory to increase output).

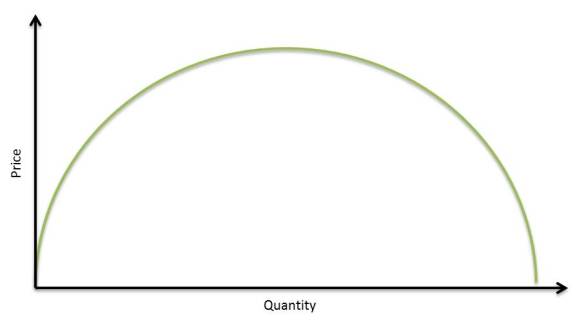

The Law of Diminishing Marginal Returns:

This graph shows how output increases over the initial short term, but in the long term output decreases. This can be explained by several factors, such as there are only so many facilities, employees waiting to use machines, rate of productivity declines as employees may begin chatting to each other or the machinery is now inefficient.

The classic example is “too many cooks in the kitchen”, if the oven is used by one cook the other cook cannot use it, if one cook used all the fish the other cook cannot use it, etc. The limitation of output increases over time due to inherent problems.

If this graph meets the x-axis and goes below it, it identifies the result of less productivity. As at any point below the x-axis adding a greater amount of a factor of production subtracts from the total output.

As a consequence of The Law of Diminishing Marginal Returns:

Shown above is the example of how adding a unit of labour increases the costs involved in production. The reason marginal cost is at the trough while marginal productivity is at the peak is because the cost of introducing more labour was small in comparison to the increased output. Therefore it can be stated that the cost is counteracted by the increase in output.

This is evident if the following example is given, at one unit of labour 100 baseballs are outputted, as there is an additional unit of labour introduced there is an additional 150 baseballs outputted, this counteracts the cost of hiring the additional unit of labour as the output has increased by 150%.

For Marginal Revenue it can be noted that as price decreases, quantity increases. This is because for the producer to sell the next good they will have to reduce the price of their good, in the sense of revenue you have to lower the price to sell more. As there is more supply the price drops as the good is less scarce.

Profit Maximisation: This is where Marginal Revenue is equal to Marginal Cost (MR=MC, Q-P)

At point Q1 there is greater marginal revenue then marginal cost, this is still a point of profit but if you stop at point Q1 you forsake possible profit and this is highlighted by the blue triangle. This is why it is worthwhile for the producer to increase one of the factors of production to increase the marginal cost with the goal of reaching the point of profit maximisation.

At point Q2 there is a greater marginal cost whereas, there is less marginal revenue. This point can be seen as equally inefficient as point Q1, as again there is loss represented by the green triangle. However it can be argued that it is better to be on this side as through this you achieve a greater market share, which is a long term interest.

Notes:

Every firm will attempt to reach the point of profit maximisation, the price of the product does not matter to the firm, and the interest is in profit.

Definitions:

Marginal Revenue: The extra revenue that an additional unit of product will bring.

Marginal Cost: The extra cost that an additional unit of product will bring.

The introduction of average revenue allows the producer to see where the price of the good should be in order for the firm to maximize profit. The average revenue can be identified as demand, and while it is in the interest of the firm to maximize profit the accurate pricing of the good is essential.

Average Revenue: Total revenue per unit of output. When all output is sold at the same price, average revenue will be the same as price.