Foreign Direct Investment is often regarded as a critical part of achieving industrialisation in developing countries. Within the framework of classical growth theory capital accumulation has a central role emphasising the need for investment. Foreign Direct Investment (henceforth FDI) goes beyond this role of assisting capital accumulation due to predicted effects such as the diffusion of new technology. It may be formally defined as a “Form of international inter-firm co-operation that involves significant equity stake and effective management decision power in or ownership of foreign enterprises.” (de Mello, 1999). This essay will argue that FDI is part of a successful recipe for industrialisation to a limited extent. The benefits of FDI will be discussed regarding how industrialisation is achieved. These being limited by the threshold conditions an economy must meet for FDI to be successful and the potential negative effects of FDI. This will be supported by evidence from the experience of economies in South East Asia.

Foreign Direct Investment can play a critical role in the industrialisation of a developing country due to its ability to improve growth through enhancing productivity, increasing competition, and enabling the spill-over of skills and technology. The critical element of FDI is the entry into the market of a multinational corporation (MNC) such that they look to produce goods of international quality at competitive prices (Calvo, Leiderman, & Reinhart, 1996). This can have an immediate impact on industrialisation as the MNC may choose to develop local infrastructure and introduce new technologies to support their production. This can involve developing roads, ports, and telecommunications often related to the needs of the relevant industry (Calvo, Leiderman, & Reinhart, 1996). The benefits of FDI go beyond this due to the incidence of technology spill-overs and vertical linkages. Spill-overs may occur as local firms observe and imitate MNCs, employees of MNC join local firms, and how the presence of MNCs may attract other high skilled services such as consultancy. This may enhance industrialisation as local firms gain information on how to more efficiently produce, use new skills, and exploit new information (Calvo, Leiderman, & Reinhart, 1996). The more prominent case for industrialisation through FDI is found in vertical linkages. MNCs have a considerable incentive to introduce technology to local firms that produce relevant inputs. As this enables the local firms to produce more at a lower cost to an international standard quality which can be achieved through training and quality control (Blalock & Gertler, 2008). MNCs will then want to avoid relying upon a single firm as this could lead to hold-ups such that they establish relationships with multiple local firms. This encourages competition amongst the vendors keeping prices lower ensuring sustained profits. The overall impact of this drives forward industrialisation as local firms improve their production techniques, exploit new technologies, and utilise any surplus captured to further enhance productivity. The beauty of this mechanism is that it operates entirely through the market such that policy intervention could be minimised to simply encouraging FDI reducing potential distortions. However, for the mechanism described above to operate such that it has a positive impact on industrialisation there are several threshold conditions which must be met, the issue of absorptive capacity, and then the potential negative effects of encouraging FDI to occur.

FDI may not result in successful industrialisation as a sole strategy due to factors which may limit its impact and quality, suggesting that alternatives must be implemented alongside it. Firstly, the limited impact of FDI on industrialisation may be viewed from the requirement of meeting threshold conditions. This involves matters such as quality over quantity, preparation for receiving FDI, consistency of government policies, promoting linkages, and how trade is facilitated (te Velde, 2001).[1] This case becomes apparent upon examining the success of FDI in promoting industrialisation between Sub-Saharan African economies and South East Asian economies. Considering the accumulated flows of FDI scaled to the size of the relevant economy countries such as Lesotho received more than Singapore (te Velde, 2001), yet they are far less industrialised. This is partially due to FDI being incident in extractive industries focused on the exploitation of natural resources rather than the aim of providing a strong productive base. Emphasising the need for certain types of FDI (the quality improving if incident in industries where there can be substantial technological gains) rather than sheer volume. Countries with poor levels of infrastructure and low human capital may not attract FDI in the first place as MNCs would need to provide this for their operations, such that the developing country must first seek to improve factors such as school enrolment or even telephone lines. Finally, there needs to be an emphasis on the role of the government how policy is practiced and whether there are suitable policies to enhance linkages and facilitate trade. Foreign investors will need assurance that capital controls will not return if they invest. Additionally, the setup of an Investment Promotion Agency (IPA) is critical as it increases the ease of business for MNCs such that they only need to coordinate with one body, and this can help the developing country to target certain kinds of FDI (te Velde, 2001). These factors and ensuring there is some level of existing skills and infrastructure would enhance the absorptive capacity of local firms such that they could reap the benefits of FDI.

FDI can potentially harm the industrialisation of developing countries, and at times government policy aligned to encouraging further investment may be less effective than alternative policies. FDI could lead to investment in industries where without the MNCs there would be no operations, this is especially problematic with resource extraction based investment where there is the repatriation of profits and then firms leave (Rodrik & Subramanian, 2009). MNCs would also look to limit any horizontal linkages to protect their rents, this may mean that even if industrialisation to a factor such as utilities occur it may no longer be worthwhile as people cannot afford to use them. There is also the potential for balance of payment related crises to occur given the financial mechanism of FDI which will be elaborated further regarding the South East Asian crisis. Alternative strategies can be used to directly target desired industrialisation namely in the form of import substitution industrialisation (ISI) and export promotion. The main advantage of these alternative strategies is their independence from foreign perceptions of the domestic economy, and are then not subject to sudden reversals. FDI may be beneficial as part of a larger industrialisation strategy but there are conflicting policy areas with alternative strategies (Rodrik & Subramanian, 2009). For example, ISI would suggest limits on importing capital goods from abroad, while an FDI strategy may require allowing an MNC to import capital goods from their supply chain.

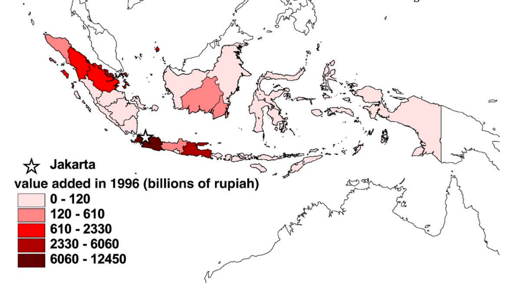

The success of South East Asian countries in industrialising is often cited as strong evidence for the benefits of following FDI based strategies. This was to an extent dispelled by the South East Asian Crisis in the late 1990s. There was a boom in FDI in South East Asia in the early 1990s, largely based around countries committing to policies suggest by the Washington Consensus such as financial liberalization. Indonesia is a prominent example of successful industrialisation since the “New Order” market reforms enacted by the Suharto regime in the 1970s (Blalock & Gertler, 2008). Notably the economy went from strong capital controls to complete financial and trade liberalization. One issue with this transition was that industrialisation varied substantially by region, as seen in the value added by region map of Indonesia (Blalock & Gertler, 2008).

FDI leading up to the crisis had led to substantial welfare and productivity gains alongside a surge in industrialisation with some estimates of productivity gains around 2%. Critically, the conditions which allowed for successful industrialisation through FDI contributed to the crisis in South East Asia. Financial market liberalization and the relaxation of capital controls led to huge capital reversals, and critically for Indonesia much of their borrowing was in dollars due to linkages with various MNCs. When the Rupiah came under speculative attacks its devaluation had substantially increased the effective debt burden. Indonesia lost approximately 13.5% of its GDP in 1998 (Aswicahyono, 2010). This had long lasting effect on growth and industrialisation with evidence suggesting that there was fewer small firms’ upscaling production, and output growth depended on existing firms which had benefitted from the initial period of positive FDI (Aswicahyono, 2010).

FDI is an undeniably effective largely market based approach in encouraging industrialisation in developing economies. The incidence of positive spill-overs emphasises the power of foreign investment provided there is the transfer of technology, and operational skills. However, it has been argued that FDI is only one element of achieving successful industrialisation. This is because of certain threshold conditions which must be met in order enable useful FDI, and ensure that local firms have an absorptive capacity of new technology and skills. These limitations are well evidenced with the Sub-Saharan experience with FDI and limited industrialisation. There are dangers to FDI being used as the ultimate solution as at times some capital controls are important for economic protection, the experience of many South East Asian economies is testament to this. Currently, the case for FDI is a direct strategy for achieving industrialisation remains ambiguous noting the failure of some globalization related policies.

A. ADIR 2017

Bibliography

Aswicahyono, H. (2010). Industrialisation after a Deep Economic Crisis: Indonesia. The Journal of Development Studies, 46(10), 1084-1108.

Blalock, G., & Gertler, P. J. (2008). Welfare Gains from FDI Through Technology Transfer to Local Suppliers. Journal of International Economics, 402-421.

Calvo, G. A., Leiderman, L., & Reinhart, C. M. (1996). Inflows of Capital to Developing Countries in the 1990s. The Journal of Economics Perspectives, 123-139.

de Mello, L. R. (1999). Foreign Direct Investment Led Growth: Evidence from Time Series and Panel Data. Oxford Economic Papers, 133-151.

Rodrik, D., & Subramanian, A. (2009). Why Did Financial Globalization Disappoint. IMF Staff Papers, 56(1), 112-138.

te Velde, D. W. (2001). Foreign Direct Investment for Development: Policy Challenges for Sub-Saharan African Countries. London: Overseas Development Institute.

[1] This is not an exhaustive list of perceived baseline requirements for FDI, rather an emphasis on key factors.