Case Study: Air Berlin

Theory of the Firm Analysis

Fixed Costs:

- Airplanes

- Labour (salaries)

- Airport Facilities

Variable Costs:

- Fuel

- Landing Fees

Define Fixed Cost: A cost that does not vary with output

Define Variable Cost: A cost that varies with output

The airplane is a fixed cost as once it is paid for the only variance in cost is through its operation. In the article it is mentioned that they look to sell 8 airplanes in the interest of reducing fixed costs as to reintroduce capital into the firm. An airplane in the majority of cases is bought outright, and this is established by the firm’s ability to sell it.

The fuel is a variable cost due to the possible change in price of fuel supplied to the airlines. The price of fuel is dependent on the microeconomic relationship of supply & demand, as the more routes an airline runs the more fuel it will need to purchase. In the article it identifies that jet fuel prices are “highly volatile” suggesting that this cost changes dependent on output.

The second variable cost is the landing fees, as more airplanes fly the greater the landing fees, as more airplanes have to pay the fee. There is also the nature of the cost of landing fees which may change; this is identified in the article through competition with Lufthansa for a central hub.

Case for Oligopoly:

Main Factors:

- Interdependency

- Competition

- Etihad (market power)

- Sustained Losses

- Abnormal Profit & Reserves

Interdependency is a clear signal of oligopolistic competition, this is identified in the article as the need to develop a new airport. To continue competition both Air Berlin and Lufthansa must expand and open new routes, which is why there is the development of another central airport in Berlin. Currently, Lufthansa have an advantage as they have more docks for airplanes at “Tegel Airport”

There is clear evidence of competition with Lufthansa, as Air Berlin is stated to be the second-largest airline in Germany. This means that domestically the two big players are Lufthansa and Air Berlin, but the article goes on to mention the involvement of Etihad Airlines. The article also identifies that there is the intention of competition in the long run against alternative airlines, as Mehdorn states that “We want to strengthen our profile as an airline company… we need long-haul flights.”

The fact that the losses of the firm are being sustained provides clear evidence that Air Berlin is part of an oligopoly. Firstly, losses being sustained shows that the firm is not part of perfect competition, in perfect competition the firm will stop production the moment losses are being made as it is “easier” to stop producing rather than leave the market altogether. Secondly, the sustaining of losses means that at point in time the firm was making abnormal profit to build cash reserves, a firm that operates with abnormal profit is at a point of monopoly, but Air Berlin still has its competitors.

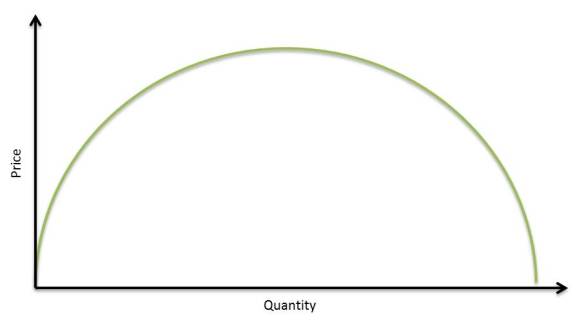

Due to the various competitions in the domestic sector mainly between Air Berlin and Lufthansa it can be argued that a kinked demand curve is in play in the German airline sector (as displayed below).

The above graph shows that they are not competing on price, this is clearly identified in the article as there is only the mention of reducing costs, introducing more routes, greater output (new airport), and airline unions (i.e. One-world Alliance). Lufthansa is shown to have a lower marginal cost due to economies of scale, as Lufthansa is a considerably bigger airline globally and in Germany in comparison to Air Berlin.

The above graph shows that they are not competing on price, this is clearly identified in the article as there is only the mention of reducing costs, introducing more routes, greater output (new airport), and airline unions (i.e. One-world Alliance). Lufthansa is shown to have a lower marginal cost due to economies of scale, as Lufthansa is a considerably bigger airline globally and in Germany in comparison to Air Berlin.

In the long run Air Berlin may be able to cut its costs down so that there is a return to normal profit, and with the eventual opening of BER the firm will be able to effectively expand and possibly compete at the same level as Lufthansa. However further delays in the opening of the new airport may mean that Air Berlin will continue to eat into their cash reserves, as stated by the article the costs per month are approximately €5 million will slowly degrade the €100 million in cash reserve. In the article it is stated that Air Berlin is selling airplanes to reduce their fixed costs, while this is appropriate action in the short run, in the long run it may mean that the firm will fail to fully utilise its new facilities of the new airport.

Case for Monopolistic Competition:

Define Monopolistic Competition: The existence of monopoly for a given firm at a given period of time in the short run. The firms in the long run will compete on price and other factors (e.g. branding, quality, etc.) eventually losing monopoly power over time as firms begin to differentiate less.

Main Factors:

- There are Many Airlines and Consumers, and no Firm Has Total Control Over Market Price

- Existence of Asymmetric Information

- Independent Decision Making

- Limited Barriers to Entry & Exit in Long Run

It is clear that there are many firms in the airline industry within Germany, and that there is a spread of consumers across the different airlines. It can be argued that no firm has clear control over market price based on external information, airlines often compete on price for specific dates or near certain events, and since there is the involvement of international airlines there is no single firm with complete control over market price.

There is clear evidence of independent decision making by Air Berlin. The first independent decision was to make a move to a new airport to act as a central hub so the firm can expand; Lufthansa had not taken any action in particular to cause this move, and it is likely that Air Berlin would have done this regardless of Lufthansa.

There is to a degree an ability to enter and exit freely into the market, this is identified by Air Berlins ability to sell airplanes, reduce unprofitable routes, and as a result reduce marginal cost. There are many competitors in the airline industry, Air Berlin could sell all of its airplanes, docks, and facilities to an international airline, or even sell parts to Lufthansa. There is the possibility of a clean exit, however in the airline industry there are many barriers to entry due to the cost of airplanes and facilities.

The diagram above shows the short run loss of Air Berlin, it can be noted that there is a shift in marginal revenue and therefore average revenue as the article states that Air Berlin begins to lose customers. There is also the issue of high fixed costs which drives the average cost curve above average revenue, as the cost of the new airport facilities is considerable.

However, in the long run it can be argued that Air Berlin shall return to a point of normal profit. This is because there is the intention to sell eight airplanes to reduce those high fixed costs. There is also the mention of introducing long haul flights and the reduction of unprofitable routes which is the reduction of the supply to meet demand. This is shown in the diagram below as the firm returns to a position of normal profit.