As a result of the financial crisis in 2007 countries within the European Union have struggled to maintain low levels of unemployment, this is the outcome of retracting economies and austerity measures. Across the Eurozone the average unemployment rate has reached a peak of 12%. The article identifies the occurrence of this peak as countries such as Greece, Spain, and Portugal all have unemployment rates around 25%. There are also fears that unemployment will further increase during April as a result of the Cypriot crisis.

Unemployment can be defined as “Those out of work, actively seeking work at the current wage rate”. This can be calculated in two ways, the first being through a claimant count (those requiring unemployment benefits) and the second being through a labour force survey. The labour force survey most often releases figures higher than through the claimant count, which is why governments tend to publish the claimant count unemployment rate.

Analysis:

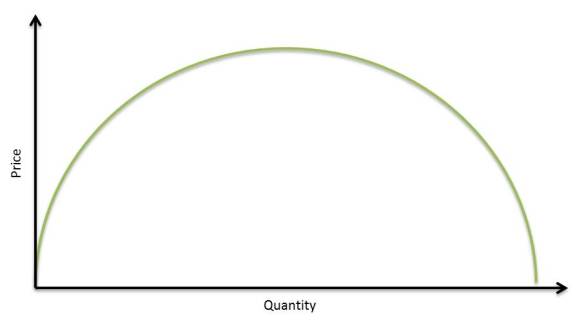

As the current unemployment rate of the Eurozone is at 12% it is understood that there is a clear surplus of people willing to work. This can be clearly shown through the demand and supply relationship for labour.

The highlighted triangle represents the unemployment as labour is demanded at LD but supplied at LS. This shows a simple representation of the current unemployment, but it does not display the causes of it.

The causes of this unemployment can be recognised through the article as cyclical and structural. Germany maintains to be the manufacturing powerhouse of the Eurozone helping keep unemployment of the country down, however countries such as Greece and Portugal do not have strong industry. This is the presence of structural unemployment as the economies require people to work jobs that they are not trained for or overqualified. The cyclical unemployment was initially the result of the initial financial crisis recession, but double-dip recession has magnified the impact on unemployment. Countries that struggle to create economic growth tend to struggle creating jobs.

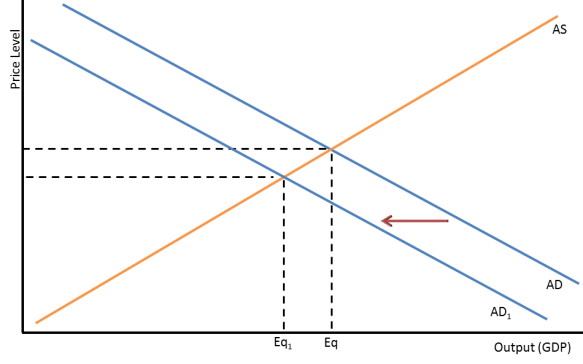

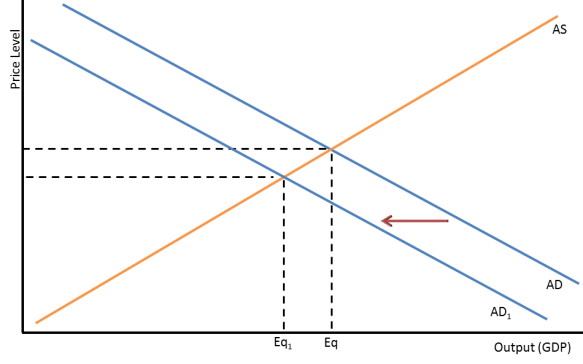

The article identifies that as a result of this continuous unemployment, the Eurozone has fallen back into recession. Manufacturing industries and other business have seen a decline in business activity, thereby showing a lack of aggregate demand throughout the European Union.

The graph above shows how unemployment in the region has affected growth prospects for the future, as shown through the movement from Eq to Eq1. The shift in aggregate demand inwards is a result of unemployment, as when people do not have a salary their effective demand is further restricted.

Evaluation:

There are clear limitations to the initial demand and supply of labour model above, this model fails to show where the unemployment is allocated (i.e. agriculture, finance, or manufacturing). Furthermore, it does not accurately represent the actual quantity of those currently unemployed. However, it does help establish the significance of unemployment as it contributes to understanding that there is a fall in aggregate demand, and therefore a dampening on growth prospects for the European Union.

The aggregate demand and supply diagram clearly shows the effect of unemployment on the European economies, and it also shows how the price level has gone down. This is true to an extent as European inflation is estimated to be at 1.8%. This identifies that in the short run disinflation is occurring within the Eurozone. This low level of inflation as a result of the drop in aggregate demand signifies that the European Union economies are struggling to achieve growth and employment. However, in the long run there may be the occurrence of reflation as the economies pursue growth, through creating more jobs and reducing unemployment.

The continuous unemployment and resultant fall in aggregate demand will have a negative effect on European manufacturing. There are already signs that business activity is diminishing (PMI=46.8 Contraction), and further unemployment will only hinder European manufacturers.

Currently across the Eurozone governments are pursuing austerity budgets to attempt to reduce debt, and climb out of recession. However, this is keeping unemployment at high rates. This attributes to a Keynesian solution of spending more to save more. If governments were to create more debt in pursuit of structural investments there may be a spur in economic growth. This can take the form of updating road networks, creating new airports, and building factories. This would help significantly aid in reducing unemployment rates in countries such as Greece, which need an infrastructural upgrade regardless.

Greggs reported that sales for the first quarter of the year and up until this point that sale have dropped 4.4%. They are blaming “bad weather, and under pressure consumers” as the cause for the fall in sales.

Greggs reported that sales for the first quarter of the year and up until this point that sale have dropped 4.4%. They are blaming “bad weather, and under pressure consumers” as the cause for the fall in sales.