Chile had escaped the Malthusian trap around the early 20th century. In this I will examine the factors that had enabled substantial growth in the Chilean economy including geography and trade, population, and institution within the period 1840-1930. The Chilean War of Independence against Spanish control began in 1810 with it ending in an independent republic being declared in 1818. From this point onwards Chile began to expand its territorial holdings in regards to assimilating the Mapuche population and gaining Northern territory, but it was only in 1840 that the economy had truly opened (Mamalakis, Markos J).Chile has a diverse regional market due to its geographic nature, as the country spans 6435 km of coastline going from desert in the North to arctic conditions in the South. (Please click to expand images!)

As Chile lies upon the North-South axis it has distinct diversity in climate and geography, the economy had been able to surpass the Malthusian trap as a consequence of this rather than be limited by it. This diversity enabled trade, demand for its exports, and increasing market integration. Chile had a particular trade advantage due to access to the Pacific Ocean and the Atlantic Ocean through the Drake Passage, and the Strait of Magellan (The World Factbook). This was to prove pivotal for the export of the factor endowments present in Chile. In the central and southern zones there is particularly fertile soil for wheat production and grazing. Then in the northern zone there is the Atacama Desert, which is the source of Nitrate and Copper (The World Factbook). While the border to Argentina is defined by the Andes Mountain range providing Chile with access to natural minerals (The World Factbook).

Trade routes proved to be integral to the growth of the export and import market that drove forward Chilean growth, which is exemplified by their increasing rate in growth rate of exports considering the data for 1850-1900, 1870-1920, and 1890-1900 shown in the table.

Further examining exports Chile had an absolute advantage in the production of wheat during what was noted as the Great Wheat Trade between 1865 and 1900 (Mamalakis, Markos J).This wheat boom had begun in 1850 as a consequence of demand from the Californian and Australian gold rushes, as exports peaked at 276,664 qq.m (quintals) for California in 1850, then 323,607 qq.m for Australia in 1855 (Mamalakis, Markos J). This highlighted Chile’s advantage due to the pacific trade routes and fertile soil, while the wheat trade was to become global with England becoming a central importer, as production between 1867 and 1900 did not fall below 800,000 qq.m (Mamalakis, Markos J). This absolute advantage in wheat production attracted foreign investment, and led to the introduction of steam ship use in Chile (Mamalakis, Markos J). The wheat trade began to decline by 1900, due to California and Australia producing their own wheat (Mamalakis, Markos J). This decline in the pacific export market for wheat did not hinder Chile’s growth due to the export of copper and nitrate.

Further examining exports Chile had an absolute advantage in the production of wheat during what was noted as the Great Wheat Trade between 1865 and 1900 (Mamalakis, Markos J).This wheat boom had begun in 1850 as a consequence of demand from the Californian and Australian gold rushes, as exports peaked at 276,664 qq.m (quintals) for California in 1850, then 323,607 qq.m for Australia in 1855 (Mamalakis, Markos J). This highlighted Chile’s advantage due to the pacific trade routes and fertile soil, while the wheat trade was to become global with England becoming a central importer, as production between 1867 and 1900 did not fall below 800,000 qq.m (Mamalakis, Markos J). This absolute advantage in wheat production attracted foreign investment, and led to the introduction of steam ship use in Chile (Mamalakis, Markos J). The wheat trade began to decline by 1900, due to California and Australia producing their own wheat (Mamalakis, Markos J). This decline in the pacific export market for wheat did not hinder Chile’s growth due to the export of copper and nitrate.

The nitrate boom began after the War of the Pacific in 1880-82, as Chile had gained the entire Atacama Desert region from Bolivia and Peru (Hutchison, Elizabeth Q., Thomas M. Klubock, Nara B. Milanich, and Peter Winn). This had also landlocked Bolivia, resulting on a trade dependence on Chile. Between 1900 and 1930 more than 50% of government revenue came from nitrate and iodine export taxes (Mamalakis, Markos J), with the nitrate sector resource surplus averaging 14% of GDP between 1882 and 1930 (Mamalakis, Markos J). In regards to helping Chile escape the Malthusian trap the nitrate boom was far more important in regards to it being a source of modernization. Integrally, bringing it closer towards modern capitalism and into contact with the United States and the United Kingdom. However, due to the synthetic production of nitrate, Chile had experienced a rapid boom and bust cycle (Mamalakis, Markos J). In this the greater move towards capitalism became the main benefit of the nitrate boom, as the nitrate bust left behind it ghost mining towns and structural unemployment showing an example of mineral theory (Adelman, M. A., and G. C. Watkins). This left copper as the most sustained specialized export, ensuring growth.

It was specialisation in the extraction of copper that was to lead to sustained growth, institutional development, and greater market integration within the Chilean economy. Until 1880 Chile had been the world’s largest copper producer, but it experienced a rapid decline in easily available stocks as production fell (Mamalakis, Markos J).

After 1910 the Chilean copper sector experienced a massive transformation, as increasing foreign investment led to greater human and physical capital that resulted in large-scale mining. This had revived copper production, while emphasising an institutional and financial link with the United States (Mamalakis, Markos J). It is debated whether the foreign presence had upheld a weak Chilean economy, or whether it provided the backbone for the modernisation.

The geography of Chile proved to be vital in providing the correct environment for access to trade, as well as a diverse range of exports. Proving essential to an increase in economic growth and modernisation, in regards to escaping the Malthusian trap increasing income per capita was a result of this trade based growth. However, it is important to consider the demographic transition that occurred in the period.

The demographic transition in Chile took advantage of growth through trade, aiding in the escape of the Malthusian trap. In the table below we see a decreasing rate of increase in population for Chile during the period in question 1840-1930, with the authors estimates with a boom in population growth for 1915-1930. There was no dramatic change in population, with the main factor being the assimilation of indigenous Mapuche population through expanding the Chilean frontier in the south through war (Hutchison, Elizabeth Q., Thomas M. Klubock, Nara B. Milanich, and Peter Winn). Instead this demographic transition was based upon increasing urbanisation and a switch to more service based sectors. In 1930 49.4% of the country’s population was located in urban areas, and increasingly the capital Santiago (Mamalakis, Markos J).

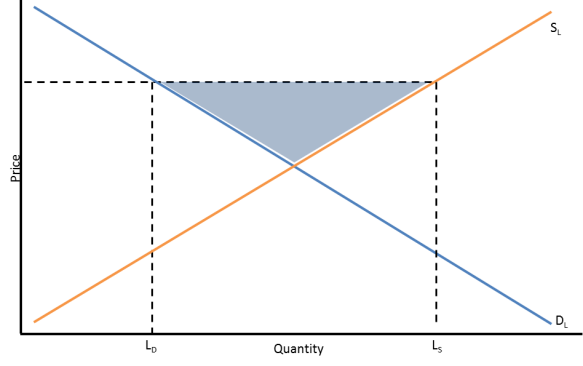

This was a consequence of the movement of employment from agriculture to industry and services, shown by the graph considering the production indices, as the public sector, and industry began to match then exceed agriculture in terms of production. This suggests that the Chilean economy had escaped the Malthusian trap between the period 1915-1930, especially considering the table below which considers the relative income and employment between 1907 and 1930, as 43% of the working population was employed in services which accounted for 50% of relative income, compared to 36% of the population being employed in agriculture (Mamalakis, Markos J).

It is important to place the trade and demographic transition that allowed Chile to experience rapid levels of growth into context with the institutions that were available at the time. Having been a Spanish colony there was already the physical and human capital required to facilitate trade, moreover the Spanish had focused on the mining of silver and gold that was to benefit the Chilean economy in regards to the production of copper and nitrate (Hutchison, Elizabeth Q., Thomas M. Klubock, Nara B. Milanich, and Peter Winn). Chilean institution in relation to aiding the escape from the Malthusian trap may be more closely examined through considering capital accumulation through physical and human capital investment, this is a consequence of the government being able to focus on aiding the export sector. Travel was the greatest institutional issue as a result of the length of the country. Therefore, between 1888 and 1930 government development expenditure increased at a rate of 4% per year (Mamalakis, Markos J), this went towards the development of customs facilities, rail network, roads, and ports. Chile had effectively set up new institutions as a result of investment into human capital through education. The government realised that it had previously failed to spread education between 1840 and 1900 this was due to rural population, poverty, inequality, and inadequate enforcement. In 1900 the system was nationalised, creating a progression from primary education until university education. This also led to the rise of vocational education in agriculture, mining, industry, and trade (Mamalakis, Markos J). Therefore, Chile had inherited some degree of institution due to being a Spanish colony creating the base of development, but then was able to develop its own institutions enabling it to improve standards of living and aid in increasing wages beyond subsistence level.

It is important to place the trade and demographic transition that allowed Chile to experience rapid levels of growth into context with the institutions that were available at the time. Having been a Spanish colony there was already the physical and human capital required to facilitate trade, moreover the Spanish had focused on the mining of silver and gold that was to benefit the Chilean economy in regards to the production of copper and nitrate (Hutchison, Elizabeth Q., Thomas M. Klubock, Nara B. Milanich, and Peter Winn). Chilean institution in relation to aiding the escape from the Malthusian trap may be more closely examined through considering capital accumulation through physical and human capital investment, this is a consequence of the government being able to focus on aiding the export sector. Travel was the greatest institutional issue as a result of the length of the country. Therefore, between 1888 and 1930 government development expenditure increased at a rate of 4% per year (Mamalakis, Markos J), this went towards the development of customs facilities, rail network, roads, and ports. Chile had effectively set up new institutions as a result of investment into human capital through education. The government realised that it had previously failed to spread education between 1840 and 1900 this was due to rural population, poverty, inequality, and inadequate enforcement. In 1900 the system was nationalised, creating a progression from primary education until university education. This also led to the rise of vocational education in agriculture, mining, industry, and trade (Mamalakis, Markos J). Therefore, Chile had inherited some degree of institution due to being a Spanish colony creating the base of development, but then was able to develop its own institutions enabling it to improve standards of living and aid in increasing wages beyond subsistence level.

The combination of geography, trade, population, and institution between 1840 and 1930 had placed Chile on the path to escape the Malthusian trap. Chile had a geographic advantage for trade with access to both the Atlantic and pacific oceans, while also being endowed with resources to export such as wheat, nitrate, and copper. Then due to the nature in which foreign investment defined the export sector there was a demographic transition, which resulted in increasing urbanisation. This was led with through the trading institution inherited from the Spanish colonialists. The economy was then transformed, as a strong government was able to build new institutions specifically education. Thereby, leading Chile out of the Malthusian trap by 1910-1920. Correlating to some degree with data map shown below:

Chile was to go on to experience economic and political turmoil that would stagnate the economy, which meant that it didn’t follow a similar to path to other countries escaping the Malthusian trap until the era of neo-liberalist economics under Augusto Pinochet (Solimano, Andrés)

Bibliography

Adelman, M. A., and G. C. Watkins. Reserve Prices and Mineral Resource Theory. International Association for Energy Economics, 2008. Print.

Hutchison, Elizabeth Q., Thomas M. Klubock, Nara B. Milanich, and Peter Winn. The Chile Reader: History, Culture, Politics. Print.

Mamalakis, Markos J. The Growth and Structure of the Chilean Economy: From Independence to Allende. New Haven: Yale UP, 1976. Print.

Solimano, Andrés. Chile and the Neoliberal Trap: The Post-Pinochet Era. New York: Cambridge UP, 2012. Print.

The World Factbook. “South America: Chile.” Central Intelligence Agency, 22 June 2014. Web. 30 Oct. 2014.

Staring, Chris. “The Nitrate Towns of Chile Photography.” Atlas Obscura.

Web. 29 Oct. 2014.

Copyright Almog Adir © 2014 · All Rights Reserved · My Website